Introducing meUSD: Unlocking the Potential of Customizable Stablecoin Indexes

Welcome back for another exciting announcement from UX!

In our previous installment, we introduced you to the concept of meTokens and explored the wide range of use cases offered within the UX ecosystem. If you missed that, don’t worry; we're here to dive deeper into one specific use case today that’s only moments away from launching on UX chain–meUSD.

What is meUSD?

We created meUSD as a response to $USDC’s depeg where what was supposed to be the safest stablecoin in all of crypto fell nearly 13%!

The meUSD token serves as a packaged asset of bluechip and cosmos-native stablecoins that spread the risk of depegging across an index of the largest cap stablecoins for much more consistent performance in your DeFi, yield-bearing strategies.

The initial proportions are as follows:

19% - $IST

25.5% - $USDC

27% - $USDT

27% - $DAI

1.5% - $USK

Note: We can always change the proportions or add other stablecoins to this index with a simple governance prop!

How did you decide the index and allocation of the stablecoins?

We chose stablecoins with large market caps as a way to ensure liquidity depth and stability. For meUSD’s risk models we ran the Monte Carlo Simulation guided by the theoretical concept of The Efficient Frontier.

For meUSD, The Efficient Frontier helps guide us in determining the best possible combination of assets that make up meUSD’s index to bring you, the UX user, the safest and risk minimized stablecoin.

Based on the Modern Portfolio Theory, Investors ideally want to build a portfolio with assets offering good returns with a combined risk that is lower than that of any individual asset in the portfolio. As a result, the more diverse the portfolio, the lower the combined level of risk.

The Monte Carlo Simulation generates thousands of random asset index allocations. These allocations are then tested against several risk and return metrics to determine the index combinations that provide the best balance between risk and stablecoin stability.

The result is that we are able to build the best possible meUSD with asset allocations that offer the most stable stablecoin with the least amount of overall risk.

What can I use meUSD for? Why not just lend my stablecoins?

Great question, meUSD will be the safest asset on UX!

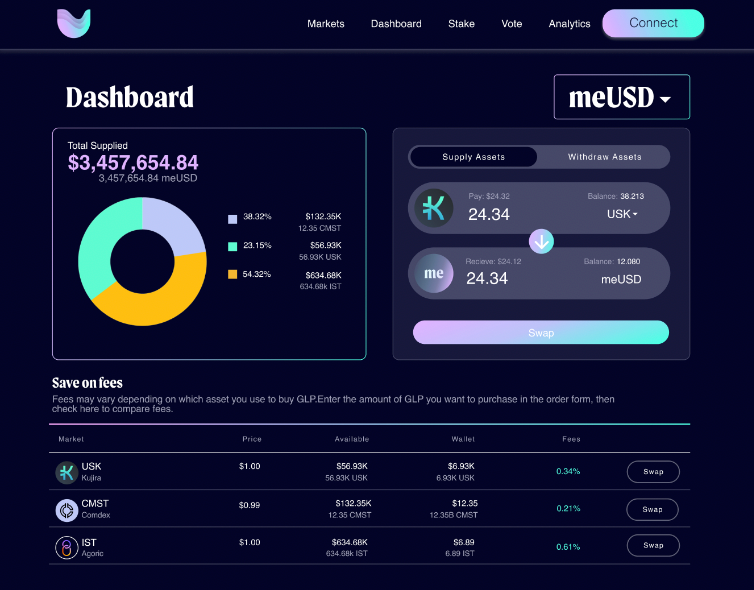

The benefit here is that since we’ve spread the risk across multiple stablecoins, your LTV ratio dramatically increases. With the recent listing of Proposal 130 you can supply your meUSD as collateral on UX! Meaning, you have even more borrowing power than before!

Rather than the original 78% borrowing limit from just lending your $USDC, you’ll now be able to borrow up to 90% of your supplied meUSD collateral!

That’s the most borrowing power you can get out of any stablecoin index in ALL of crypto, let alone Cosmos.

Yeesh!

How do I get meUSD?

It’s simple! All you have to do is convert any of the included stablecoins from the index. UX Chain charges a small, dynamic minting fee, and voila, you have meUSD!

How do Dynamic Fees work?

The Dynamic Fees work on a variable fee structure and adhere to UX’s strict security parameters. When the deposits follow the target allocations as defined above, the target fee for creating meUSD is 0.25%. If the actual deposits of certain tokens go above or below the desired number, the dynamic fee will increase or decrease to incentivize users to choose which stablecoins to use to create meUSD. The dynamic fee feature is implemented to ensure the meUSD construction will always move back to its optimal allocation that has the minimum price risk.

Dynamic fees work conversely with swapping your meUSD back into stablecoins to deter any mercenary short-term collateral. If a specific collateral asset is undersupplied and you swap meUSD back into said undersupplied asset, the fee will be higher. If the asset is oversupplied, your swap fee will be lower giving users as a whole more incentive to keep the index balanced.

Am I missing anything else? Is there anything else I should know?

Yes! I’m glad you asked.

There’s an arbitrage opportunity here.

If the pool were to become unbalanced, the exchange rate would change.

For example, say $IST were to depeg. You could then take your supplied meUSD, exchange it for $IST, swap that $IST for $USDC on Osmosis, and resupply it back into meUSD, effectively increasing the original amount of meUSD you had. Boom. Arbitrage.

What’s next for UX Chain and meUSD?

This is a first-of-its-kind asset that we’re launching at UX, and for Cosmos, but meUSD isn’t all we plan on doing…

Using the same indexing technology that yielded meUSD, we’ll begin to create meLSD for $ATOM and $ETH liquid staking derivatives!

Imagine having a packaged asset of $ATOM or $ETH composed of multiple liquid staking derivatives?!

We can’t say much now, but stay tuned, and keep an eye out on our X profile for meUSD to hit the front end of UX this X day and be the first to mint your meUSD!

Try them out for yourself 👉 app.ux.xyz

Best regards,

The UX Team.